‘Delay’ and ‘Deny’: Even Health Insurance Companies Agree Prior Authorization Process Is Broken

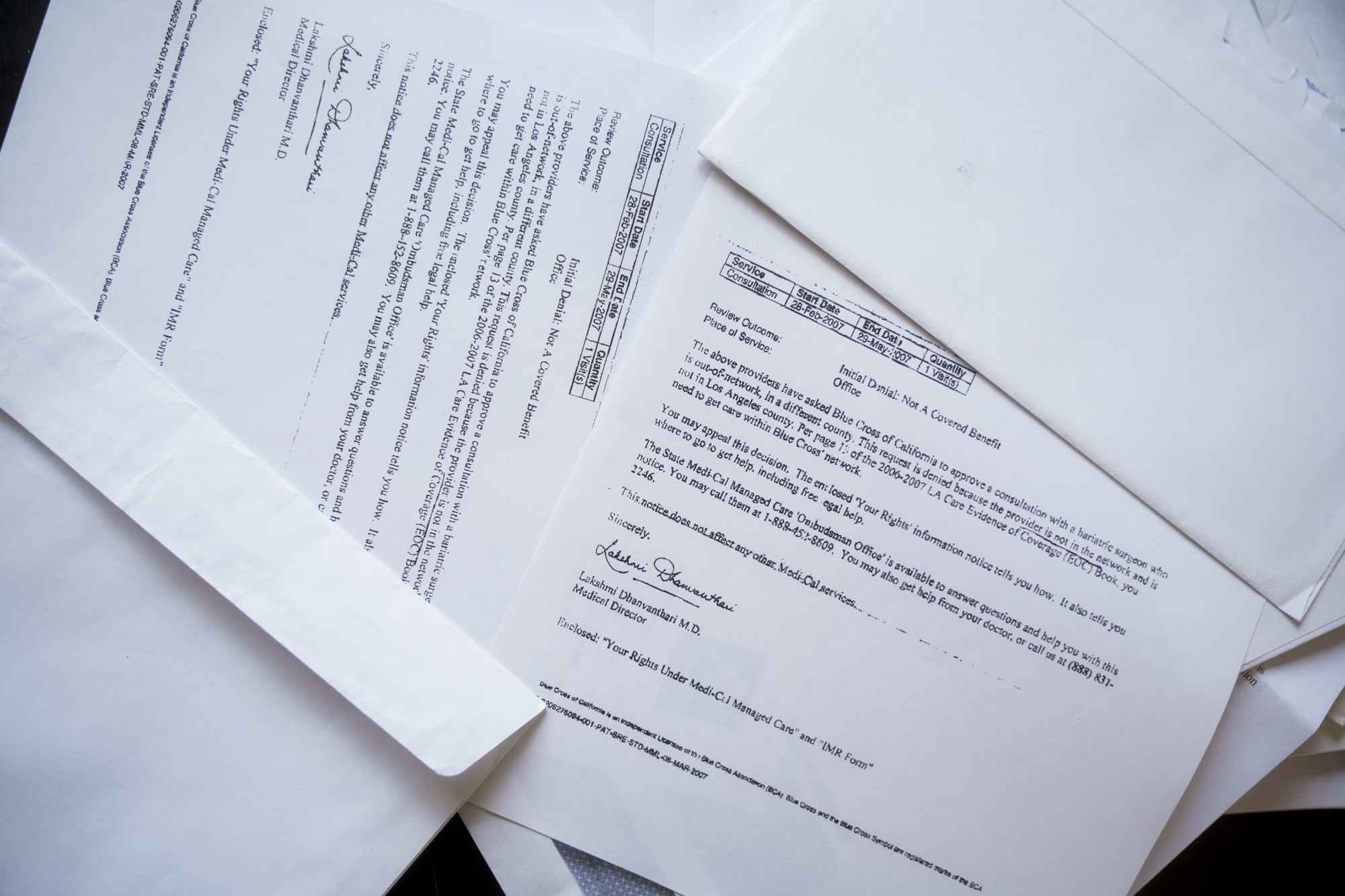

Ocean McIntyre goes through a file folder of health insurance claims and denial letters at her home in Panorama City on Feb. 10, 2026. (Jules Hotz for KQED)

When Ocean McIntyre started having vision problems at age 34, her health plan took a month to authorize a doctor visit.

When pressure in her brain started crushing her optic nerve, she spent three months tangled in bureaucratic red tape before the insurer finally permitted her to see a specialist, a neuro-ophthalmologist.

“He said if you had been seen earlier, we could have preserved your vision,” McIntyre remembered. “Now we’re just trying to see if we can save any of your vision. That was the first time it really clicked that the life that I had before was over.”

After a wide-ranging career as a tattoo artist, a private pilot, and a research assistant at NASA’s Jet Propulsion Lab near Pasadena, McIntyre is now 51, legally blind and struggling to find work. “I have no peripheral vision at all. It’s like looking through a straw, and what I see is semi-clear in one eye and completely blurry in the other,” she said. “I fall, I trip on things all the time, even in my own house. I’m obviously not flying anymore, not driving a car anymore.”

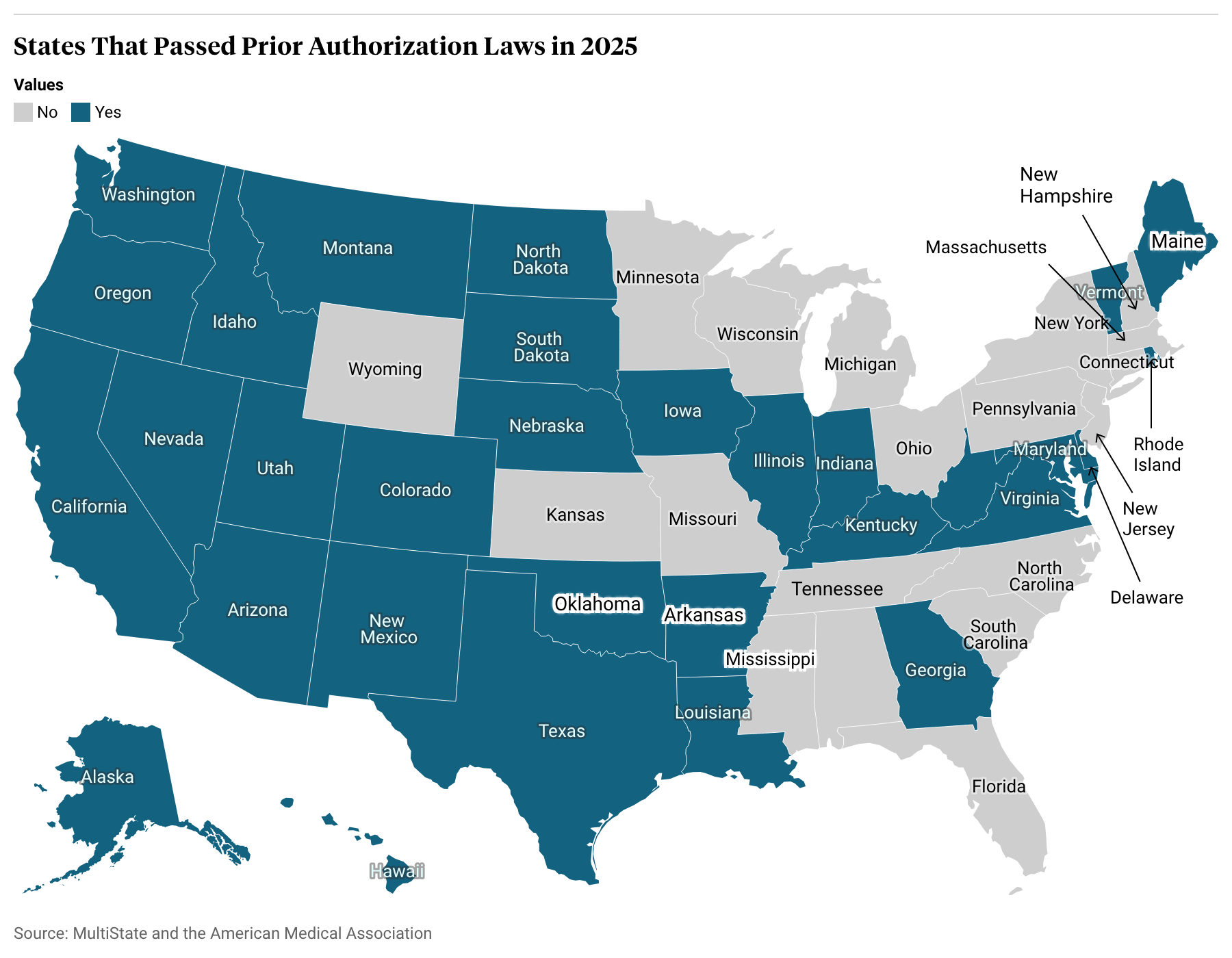

For decades, patients like McIntyre and their doctors have pressed California and other state lawmakers to rein in health insurers’ ability to review or refuse coverage for medical services after a physician has ordered them, a practice known as prior authorization. But the conversation shifted in December 2024 when Luigi Mangione allegedly murdered UnitedHealth CEO Brian Thompson, using bullets etched with the words “delay” and “deny.” The next year, an unprecedented 31 states, at least, passed laws limiting the use of prior authorization, almost all with bipartisan and near-unanimous support.

While momentum for legislative change had already been building, several industry insiders and observers said the assassination of an insurance executive, and especially the public outcry that followed, was the catalyst that pushed so many laws over the finish line in 2025. Tens of thousands of people took to social media to both condemn the violence and to air their grievances about insurance tactics and barriers to care.

“It really highlighted for the country this amount of anger,” said Miranda Yaver, health policy professor at the University of Pittsburgh. “And I think that placed pressure on state legislatures.”

Health insurers felt the pressure, too, as lawmakers complained during committee hearings about their own experiences with prior authorization before voting in favor of local bills.

By summer 2025, a coalition of insurance companies issued a pledge to voluntarily streamline, simplify, and reduce the use of prior authorizations. Especially where state legislation aligned with these principles or was narrowly tailored, the insurance industry was more receptive than it had been in the past. Where there was still friction, insurance lobbyists stated their objections, but often struck a conciliatory tone.

“Prior authorization process today sucks. We all take accountability for it,” saidPaul Markovich, CEO of Blue Shield of California, at a congressional committee hearing in January featuring a panel of five health insurance executives. “We are fixing it by reducing the number of services that are covered, offering an online service, and standardizing electronic submission of data.”

Prior authorization started out as a tool insurers used to control costs and tosafeguard patients against unnecessary or harmful treatments. It is typically applied to high-cost items, like experimental treatments, hospitalizations and surgeries, and certain prescription drugs.

For example, back surgeries are often denied because clinical trials show they provide little to no benefit to people who suffer from back pain compared to exercise and physical therapy. Brand-name medications can often be replaced with equally effective, but significantly cheaper, generic alternatives.

“These efforts help keep coverage as affordable as possible,” said Chris Bond, spokesperson for AHIP, a national trade association for the health insurance industry.

But in more recent years, doctors complained that insurers were abusing prior authorization, applying it to more services or using it as a tactic to delay and deter patients away from care. In a 2024 national survey, doctors said they and their staff spent an average of 13 hours a week dealing with prior authorization requests; 23% of doctors said their patients had been hospitalized because of prior authorization delays, 18% said they’d experienced a life-threatening event, and 8% said a patient suffered permanent disability or death.

The mountains of paperwork and constant second-guessing by insurers drive burnout and push doctors into early retirement, said René Bravo, a pediatrician in San Luis Obispo and president of the California Medical Association.

“There is nothing that causes physicians’ blood pressure to elevate like prior authorization,” he said. “You just say the word, and doctors bristle.”

California targets insurance companies

States are taking different approaches to regulating the insurance industry’s use of prior authorization. Some, like Nebraska and North Dakota, focused on expediting the process, mandating timelines for when reviews must be completed, while others restricted the use of artificial intelligence in making determinations.

Many states, including Texas, Arkansas, and West Virginia, have instituted “gold card” programs that exempt doctors from prior authorization if the treatments they order already have a high rate of approval. Others, including Rhode Island and Montana, focused on exempting certain treatments, such as preventive care, insulin, mental health and substance abuse treatment, or some cancer care.

“The California law is different. It puts the onus on the health plans,” said David Aizuss, an ophthalmologist in Los Angeles and chair of the board of trustees at the American Medical Association, which has been tracking state legislation.

SB 306 said that if a health insurer approves a medical service more than 90% of the time in one year, then it can’t require prior authorization for that service the next year.

“This creates a data-driven, common-sense approach,” said state Sen. Josh Becker, D-Menlo Park, who authored the bill. “If you’re approving it anyway, don’t make patients, providers jump through hoops.”

Though attempts to pass a previous version of this bill petered out in 2023, Gov. Gavin Newsom’s office was particularly involved in the passage of SB 306, mediating differences between doctors who supported it and insurers who opposed it, and directing the state Department of Managed Health Care to offer technical assistance.

The regulator is leading the implementation of the law. By July 2026, officials will instruct insurers on how to report the statistics that will be used to list procedures and medications that will be exempted from prior authorization, which regulators expect to publish by July 2027.

Aizuss believes a range of medications for hypertension, diabetes, asthma, and arthritis will make it onto the list, as well as certain outpatient mental health treatments and cancer surgeries.

He’s hopeful that California’s broad approach will lead to more overall transparency and be more effective than other states. Insurers have found loopholes to skirt around the requirements of gold card laws, he said, and the burden is on doctors to prove they should be exempt from prior authorization. For example, in Texas, only 3% of doctors have qualified for gold card status, Yaver said. The California law, by contrast, requires insurers and regulators do the legwork. “This is a positive step toward relieving physician administrative burden,” Yaver said.

Whatever the approach, McIntyre is relieved to see progress in California and across the country. She said no one should suffer a heart attack or a cancer relapse, or lose their vision, because they had to wait for care.